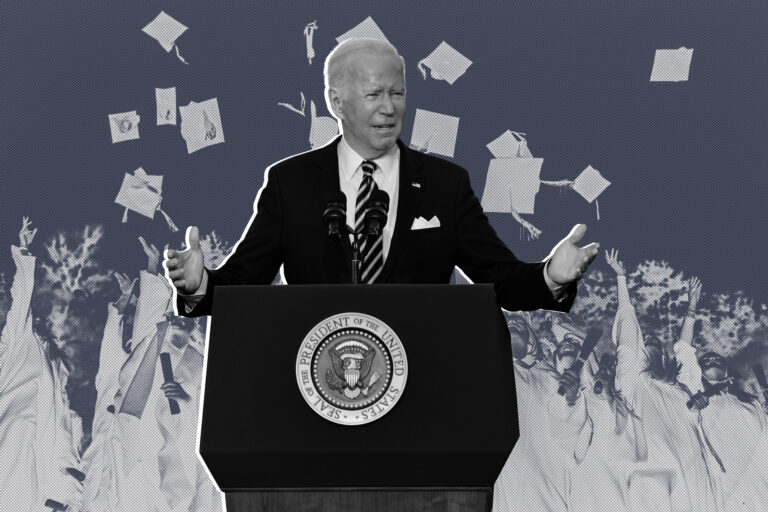

Tell President Biden and his administration to cancel all student debt

President Biden announced a program that provides undergraduate and graduate students with up to $10,000 in debt relief for national and community service. Senator Sanders says this isn’t enough and urges the president to cancel all $1.8 trillion in student debt, including private and federal student loans. How? Sanders would enact a speculation tax that would raise $2.4 trillion over ten years.

The cost of higher education in America has been rising steadily for decades; in 2021, students at public universities paid an average of $9,580 in tuition and fees, while students at private colleges paid an average of $33,150.Americans owe more in student loans than any other type of debt except mortgages.In addition, federal funding for state schools has declined by more than 20 percent since the 2008 recession.Student loan debt is a considerable drag on the economy. Increasing education costs prevent students from making major life decisions, such as getting married, buying a home, or starting a family.American public universities are less accessible than they should be — while saddling recent graduates with debt, they have little hope of repaying on time. According to the Education Data Initiative, student loan default affects 9 million borrowers and their families — about 15 percent of borrowers.

Senator Sanders’ plan, however, faces a major roadblock: President Biden has said he does not fully support it. It is a fact that the Biden administration can cancel student debt in a number of ways, but they are not using these options.

Senator Sanders’ plan would help our nation build a more prosperous future by eliminating student loan debt. We can accomplish this without burdening taxpayers or negatively impacting our economy at large. By supporting Senator Sanders and his supporters today, you are in solidarity with millions of Americans, like me, being hit with higher education costs and lower employment opportunities, creating a vicious cycle of debt and underemployment. Education is vital to the strength of this country. Students who cannot afford college have given up on their dreams for too long. This must change.

The student loan burden weighs heavily on the economy, slowing business formation and entrepreneurship. Student loan debt is associated with lower credit scores and an increased risk of defaulting on other debts. In addition to improving borrowers’ credit scores, student debt forgiveness would give more people cash to invest elsewhere. Americans are struggling to pay interest on their loans.

The brunt of student loan debt falls hardest on those who can least afford it. Therefore, we are asking you, along with the members of Congress, to cancel all student loans and pass Senator Sanders’ College for All Act. It would benefit our economy to immediately cancel all student loans for 45 million borrowers owing $1.8 trillion. This means we could hire more teachers, pay more entrepreneurs to start companies, and create jobs that provide opportunities for everyone. There is nothing to lose and everything to gain from canceling student loan debt and embracing Senator Sanders’ plan.

In 2022, elected officials will face pressure from lobbyists working for educational institutions that profit off student loans — but we can be bolder! Collectively we have massive amounts of power to put pressure on our elected officials — we can deliver a message so loud that not even Mitch McConnell can ignore it. We must act now in support of Senator Sanders’ call for a better future for all Americans.

Sources:

1. Pager, T. (2022, May 27). Latest White House plan would forgive $10,000 in student debt per borrower. The Washington Post. https://www.washingtonpost.com/us-policy/2022/05/27/biden-student-debt-borrower/

2. Friedman, Z. (2022, February 25). Student loan forgiveness: Bernie Sanders says Biden should cancel all $1.8 trillion of student loans. Forbes. https://www.forbes.com/sites/zackfriedman/2022/02/23/bernie-sanders-wants-biden-to-cancel-all-18-trillion-of-student-loans

3. Friedman, Z. (2020, December 15). This is how Bernie Sanders will pay for $1.6 trillion of student loan forgiveness. Forbes. https://www.forbes.com/sites/zackfriedman/2020/02/25/student-loan-forgiveness-bernie-sanders

4. Hanson, M., & Checked, F. (2021, December 3). Average private vs public college tuition [2022]: Data analysis. Education Data Initiative. https://educationdata.org/private-vs-public-college-tuition

5. The Federal Reserve System: Consumer Credit: https://www.federalreserve.gov/releases/g19/current/default.htm

6. Mitchell, M., Leachman, M. L., & Masterson, K. (2017, August 23). A Lost Decade in higher education funding. Center on Budget and Policy Priorities. https://www.cbpp.org/research/state-budget-and-tax/a-lost-decade-in-higher-education-funding

7. Hess, A. J. (2021, July 2). 3 ways student debt impacts the economy. CNBC. https://www.cnbc.com/2021/07/02/3-ways-student-debt-impacts-the-economy.html

8. Hanson, M. (2021, December 19). National Student Loan Default Rate [2022]: Delinquency data. Education Data Initiative. https://educationdata.org/student-loan-default-rate